does binance send tax forms canada

Youll pay either Capital Gains Tax or Income. Binance launched and implemented its first-ever auto-burn program the BEP-95 in the fourth quarter of 2021 which calculates the number of BNB tokens to be burned using a formula based on the total number of blocks produced on the Binance Chain and BNBs average dollar.

3 Steps To Calculate Binance Taxes 2022 Updated

Go to the Binance API page by hovering over the user icon in the top header and then click API Management.

. But there could be tax consequences when you do any of the following. For those types of people they could handle the kind gesture from the Gov. You will see a Setup Binance API pop up.

No they stopped issuing 1099-K s from 2021 so they dont report to the IRS. Binance Alternatives in Canada There are several crypto trading apps you can use in Ontario and the rest of Canada if you want to avoid the risks of Binance getting banned. Yes binance does provide tax info but you need to understand what this entails.

If you want to access Binance from Ontario you will have to use a VPN. It told customers on June 25 that the province became a restricted jurisdiction and that it can no longer continue to service Ontario-based. We have integrated binance via api on beartax with which one can consolidate trades review.

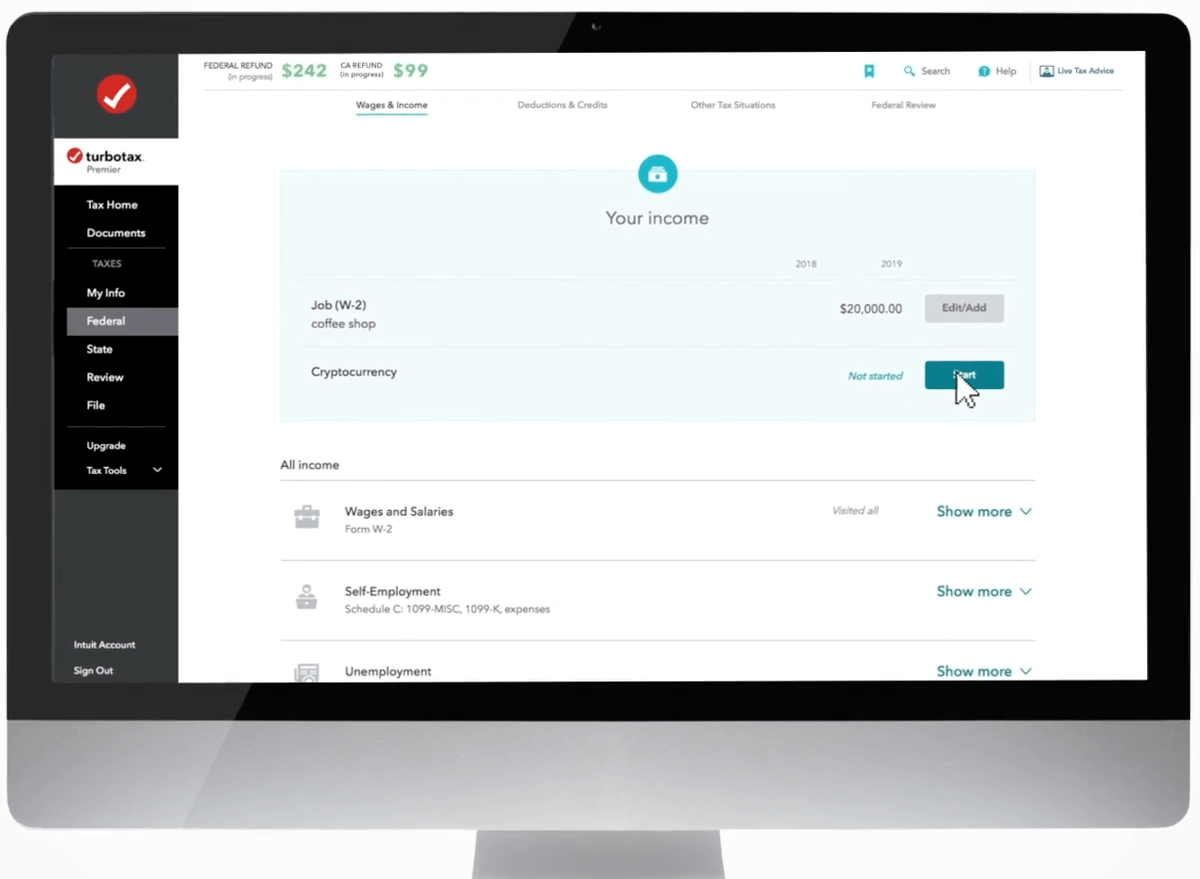

In theory every transaction is a taxable event. Yes Binance is legal in Canada except in Ontario. File these crypto tax forms yourself send them to your tax professional or import them into your preferred tax filing software like TurboTax or TaxAct.

In general possessing or holding a cryptocurrency is not taxable. If your account meets both of the above criteria BinanceUS will send you a Form 1099-K in January 2021 to your accounts address of record. Firstly click on Account - API Management after logging into your Binance account.

By law the exchange needs to keep extensive records of every transaction that takes place on the platform. Label your wallet name click Setup auto-sync. At the time of writing as a Canadian you could open an account with Binance.

Yes Binance does provide tax info but you need to understand what this entails. The cra is behind the curve when it comes to crypto tax in general. Binance is currently one of the top rated crypto exchanges ranked 19 out of 199 in our reviews of Canada crypto exchanges with a rating of 7810.

If you bought a crypto 100 and sell it for 200 you have to. The Canada Revenue Agency has released guidance on cryptocurrency taxes in Canada - but theyre not always straightforward. If you have crypto transactions that qualify for capital gainloss this form should be.

Enter the unique API keys and Secret Key you received from the. Binance does not issue a 1099 form to its customers because it is not a US-based exchange and it no longer serves US. Relevant Tax Forms Form 8949 This form is used to report sales and exchanges of capital assets.

Three of the main jurisdictions where this happens are the United Kingdom the. Based exchanges such as Coinbase and Gemini will fill. No Binance doesnt provide a specific Binance tax report - but it is partnered with a variety of excellent crypto tax apps like Koinly that can.

According to their website. Click Get code to receive a verification code to. Binance Tax Reporting You can generate.

Does Binance Send Tax Forms Canada. However you need to keep in mind that you wont be able to fully verify. Does binance provide tax forms.

This transaction is considered a. As a result your cryptocurrency activity on Binance and other platforms is subject to capital gains and ordinary income tax. In June 2021 Binance pulled out of Ontario.

Binance does not do much of the hard work for you when it comes to calculating your crypto taxes. If you dispose of your crypto-assets youll incur. Does Binance report to tax authorities.

Be mindful that because Binance is outside of Canada you may be require to file a T1135 form with the. The IRS will receive a duplicate. Here is a step by step procedure on how to get your tax info from Binance.

Sell or make a gift of cryptocurrency trade or. Click on Create Tax Report API. Previously BinanceUS took the position that it was a Third Party.

Does Binance provide a tax report. Binance does not provide tax advice.

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support

3 Steps To Calculate Binance Taxes 2022 Updated

China Might Shut Down The Country S Bitcoin Exchanges Bitcoin Price Cryptocurrency Bitcoin Transaction

3 Steps To Calculate Binance Taxes 2022 Updated

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support

Binance S Exit From Ontario Amid Regulatory Action By Osc

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support

3 Steps To Calculate Binance Taxes 2022 Updated

How To Report Your Crypto Taxes In Canada In 2022 Ocryptocanada

Why This Security Stock May Not Be A Safe Bet Before Earnings Schaeffer S Investment Research In 2022 Dividend Dividend Stocks Price Chart

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support

3 Steps To Calculate Binance Taxes 2022 Updated

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support

3 Steps To Calculate Binance Taxes 2022 Updated

100 Legit Track Mtcn Before Payment Contcat Us For Your Own Mtcn Today Get Western Western Union Money Transfer Western Union Money Market Account

The Nature Of Money Is Changing But Who Will Be The Leader In The Issuance Of Digitalcurrency Is Still Up For Cryptocurrency Micro Cap Stocks Financial News